-

![]() Upcoming Event

Upcoming Event2026 Charity Golf Tournament

Join us for the 9th Annual Cal Coast Cares Foundation Charity Golf Tournament presented by Mastercard®, taking place on Monday, August 17 at Fairbanks Ranch Country in Rancho Santa Fe.

Learn More -

![]()

Holiday Closure Announcement

As a reminder, Cal Coast branches will be closed in observance of the Presidents' Day holiday on Monday, February 16. Online and mobile banking options are available 24/7.

Learn More -

Workshops

Spend Less, Have More: Practical Ways to Reduce Expenses

Join us for an informative in-person workshop on how to reduce expenses.

Learn More -

![]() Workshops

WorkshopsProtecting Our Seniors: Understanding Financial Elder Abuse

Join us for an informative in-person workshop on financial elder abuse and how to protect our seniors.

Learn More -

![]() News and Events

News and EventsMartin Luther King Jr. Day

In observance of the Martin Luther King Jr. Day Holiday, Cal Coast Credit Union will be closed on Monday, January 19, 2026.

Learn More -

Webinar

Smarter Goals, Stronger Finances, Brighter Futures

Smarter Goals, Stronger Finances, Brighter Futures

Learn More -

![]()

New Year's Day Closure

We will be closed starting at 1pm on Wednesday, December 31 through Thursday, January 1, in observance of New Year's Day. We will resume normal business hours on Friday, January 2, 2026. Online and Mobile Banking along with CoastLine are available to members 24/7. We hope you have a safe and fun holiday.

Learn More -

![]()

Christmas Holiday Closure

Cal Coast will be closed starting at 1pm on Wednesday, December 24 through Thursday, December 25, in observance of Christmas. We will resume normal business hours on Friday, December 26.

Learn More -

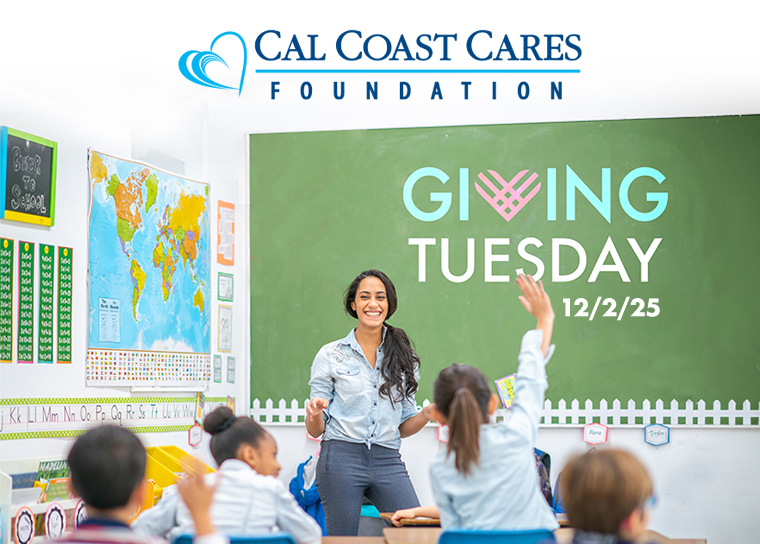

![]() Giving Back

Giving BackSupport Students and Education

This GivingTuesday, we invite you to make a lasting impact on the lives of local students and educators through scholarships and educator grants.

Learn More -

![]()

Holiday Closure Announcement

On Thursday, November 27, Cal Coast will be closed in observance of Thanksgiving. We will resume normal business hours on Friday, November 28.

Learn More